|

What is a credit card |

A Credit Card is a small card, made from plastic, issued usually by banks or other financial institutions for users (consumers), as an easy way of payment for goods and services.

You should note that credit cards are one of the most easy and popular ways of borrowing money for many of us, typical consumers.

You should note that credit cards are one of the most easy and popular ways of borrowing money for many of us, typical consumers.

What is a credit card?

|

The issuer of the credit card, grants a line of credit to the user (consumer). User of credit card is able to borrow the money to use them as a payment at shopping places where, points of sale machines accept credit cards payments.

In shortly, holder of the credit card is allowed to buy goods and services and re-pay the balance of the borrowed money, later on. On the right picture: Example of consumer reward card, issued by Amazon. |

|

This means that credit card is a flexible way of borrowing money and allows you spread the cost of your purchase(s) in time.

You should be aware that the flexibility of purchasing possibilities comes at a cost for you. Banks or card issuing companies charge interest on any outstanding balances left at the end of each month.

You should be aware that the flexibility of purchasing possibilities comes at a cost for you. Banks or card issuing companies charge interest on any outstanding balances left at the end of each month.

Please do not mix a debit card with credit card

When you spend money by using your credit card, in fact, you are borrowing that money against your credit limit. On the second side is debit card that is tied to your current or checking account. Debit card help you withdraw funds for spending money you own, in the form of purchase goods or withdrawing cash at ATM, for example.

|

On the right picture: British Airways Signature Credit Card issued with Chase Bank, which is in fact travel rewards credit card.

I like the design of this card with blue Earth as background. The shape and size of conventional credit card is internationaly specified by ISO standards. Regular card size is defined as 85.60 × 53.98 mm (3.370 × 2.125 in) (33/8 × 21/8 in). |

|

Categories of credit cards

- 0% Intro APR Credit Cards - usually, this introductory rate is available for up to 12 - 15 months from the time you open the credit card account, and depending on the offer and the issuer regulations.

- No Annual Fee Credit Cards

- Balance Transfer Credit Cards - If you plan to close some other credit cards then, this balance transfer credit cards can help you consolidate your credit card balances all onto one card.

- Rewards Credit Cards - This category include e.g. airlines cards, hotel chain cards, travel cards, cash back cards, gas cards, retail cards and all other various rewards credit cards.

- No Foreign Transaction Fee Credit Cards - Credit cards with no transaction fees are perfect for the international traveler because eliminate transaction fees from all foreign credit card purchases.

- Business Credit Cards - For all kind of businesses. Some banks also provides free business credit cards for employees.

|

On the right picture: Disney's Premier Visa® Card (issued by Chase Bank) have colorful interesting graphics.

Among many perks that this card offer, you can earn unlimited reward dollars on purchases and redeem them for most everything Disney (as for March 2013, when this article was written). |

|

Frequently asked questions concerning credit cards

- What is the APR rate? - APR means Annual Percentage Rate and is the cost of credit calculated as an annual percentage. To determine the monthly periodic rate, please divide the APR rate by 12 months. Some banks offer 0% Intro APR Credit Cards (usually 0% APR in first 12 to 15 months).

- What is an interest charge? - An interest charge is the sum of interest on your credit card account, and is broken down by transaction type: purchases, cash advances and balance transfers. If you pay less than the full balance or pay after the payment due date then, you will pay interest. Cash advances and balance transfers have no interest free period, and start accruing interest as soon as the transaction is made, and will result in interest due, even if your balance is paid in full.

- What is a Credit Limit? - The credit limit is the maximum amount of credit available to you for purchasing goods and services. Please note that there is also the Cash Credit Limit, which is the amount from your Total Credit Limit available for cash advances.

- What is a balance transfer? - A balance transfer is when the outstanding balance of one credit card(s) is moved to another credit card account. Usually, balance transfers are possible with most credit card accounts where you currently carry a balance (including gas credit cards and retail credit cards).

There are much more features concerning using credit cards. Please search for FAQ and information when you search for specific credit card and specific issuer.

Some credit card history

|

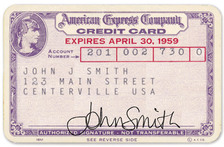

American Express Company was among the early birds in credit card business.

AmEx started to offer first charge card in October, 1958, with an annual fee of $6. (that means the intention to position the American Express as the premium charge card). On the left picture: the first American Express credit card. |

Today, American Express is a payment network (they license the network for other banks to use on their cards) and directly card issuer (as from 1958).

Cards include famous Green card, but also a range of many other, like business card called "Blue for Business" or travel-reward card called, "Gold Delta SkyMiles" to name a few.

Cards include famous Green card, but also a range of many other, like business card called "Blue for Business" or travel-reward card called, "Gold Delta SkyMiles" to name a few.

Direct predecessor of the credit card was so-called charge card. Holder of charge card, was required to pay the full balance, each month. There were not any credit involved in charge cards.

Credit cards have changed the situation. Credit cards allow holders to get line of credit and continuously use the borrowed money for purchases, up to the credit limit. As for all kinds of credit, there are interests rates are added to the credit balance, as a payment (reward) for lender of the money.

Credit cards have changed the situation. Credit cards allow holders to get line of credit and continuously use the borrowed money for purchases, up to the credit limit. As for all kinds of credit, there are interests rates are added to the credit balance, as a payment (reward) for lender of the money.

Author: Mr. Dariusz Kudłaty is owner and developer of this Best Financial Directory. He loves to write financial-related and credit card-related articles, news and stories. He try to publish quality content, presented for you on this website. Enjoy!