|

Improve Your Credit Score |

On our informative pages, you will find some effective tips and consumer propositions concerning improving your Personal Credit Score.

Regardless of your personal economic situation, if you are interested in having a high credit score, there are several things you can do.

While having a good credit score can help you obtain a low-interest mortgage or car loan with low-interest payments. However, if you don't have enough money to pay your bills on time, it will be pretty hard to improve your

personal credit rating.

After you have your essentials covered, you can now think about improving your credit score.

While having a good credit score can help you obtain a low-interest mortgage or car loan with low-interest payments. However, if you don't have enough money to pay your bills on time, it will be pretty hard to improve your

personal credit rating.

After you have your essentials covered, you can now think about improving your credit score.

When comes to credit score: Be Patient and Stay Determined! You should be forewarned that improving credit scores takes time and patience. How much time it takes? It all depends on what kind of damage already exists.

In fact, the more damages on your credit report, the longer it may take to improve your credit score.

However, if your credit report is, let me say not damaged, but you just want to improve your credit rating, you will still need to put in some work.

However, if your credit report is, let me say not damaged, but you just want to improve your credit rating, you will still need to put in some work.

Check Your Credit Report Frequently

|

Credit score is a kind of report about your personal finances and describes, e.g. how well you handle your credit.

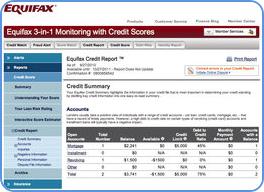

Please check in on your Credit Report frequently beacusae, your credit score depends on what's going on with your credit report. Any blemishes that may be inaccurate may be hurting your credit score and you may not even know about it. On the left picture: Equifax credit report sample page. You may read more details about Credit Reports. |

Lenders usually take a positive view of individuals with a range of credit accounts, mean credit cards, car loan, mortgage, etc. - that have a record of timely payments. However, a high debt to credit ratio on certain types of revolving (credit card) accounts and installment loans will typically have a negative impact.

You should know that credit scores are pretty sensitive to whether you pay your bills on time or not. This means late payments will negatively impact your score rating. In order to avoid this, major credit card companies have automatic payment systems. This helps you avoid forgetting to pay your vredit card bill because of a busy schedule.

You have to use your credit cards and do not be afraid of using them. Of course, you have to use them responsibly, and not recklessly. Using your credit and paying off high balances will help improve your credit score.

On a final note, do not unnecessarily pull your credit report. Each time you do so, you hurt your credit.

You should know that credit scores are pretty sensitive to whether you pay your bills on time or not. This means late payments will negatively impact your score rating. In order to avoid this, major credit card companies have automatic payment systems. This helps you avoid forgetting to pay your vredit card bill because of a busy schedule.

You have to use your credit cards and do not be afraid of using them. Of course, you have to use them responsibly, and not recklessly. Using your credit and paying off high balances will help improve your credit score.

On a final note, do not unnecessarily pull your credit report. Each time you do so, you hurt your credit.

Basics for Improving Your Credit Score

Improving a credit score is a kind of game that you need to play to get better interest rates on loans. When comes to buying big ticket items like cars and mortgages, the differences between interest rates, could cost you a lot of money.

However, in fact, improving a credit score is not so difficult like it sounds, at the beginning and just involves using a lot of little strategies, small "wise" steps and paying close attention to your spending.

However, in fact, improving a credit score is not so difficult like it sounds, at the beginning and just involves using a lot of little strategies, small "wise" steps and paying close attention to your spending.

|

If possible, you should carry more than one type of credit card.

Having a different types of credit cards in your wallet and paying them on time, boosts your credit worthiness rapidly. Having only one credit card, could be seen admirable and credit bureau could see this situation, as a sign of self restraint and financial responsibility. |

But a high credit score often requires you to play the game. Its a strategy - so take out another credit card if you only have one. I recommend one American Express card and one VISA or MasterCard.

In fact, the VISA and MasterCard credit and debit cards are more widely accepted, and you can carry a balance for absolute emergencies. Alternate the cards by month or season - using only one.

Please have in mind that, you have to use the credit to improve your score. Having the credit card sitting stagnant with a zero balance does nothing for you. In fact, inactive card could hurt you since inactive cards are getting charged an inactivity fee, or are being closed by the lender – which inevitably hurts your score.

Therefore, just make some small purchases, from time to time and charge it to your card. Pay the balance every month, and you’re good on the balance end.

In fact, the VISA and MasterCard credit and debit cards are more widely accepted, and you can carry a balance for absolute emergencies. Alternate the cards by month or season - using only one.

Please have in mind that, you have to use the credit to improve your score. Having the credit card sitting stagnant with a zero balance does nothing for you. In fact, inactive card could hurt you since inactive cards are getting charged an inactivity fee, or are being closed by the lender – which inevitably hurts your score.

Therefore, just make some small purchases, from time to time and charge it to your card. Pay the balance every month, and you’re good on the balance end.

Some more small but guaranteed tips below, on boosting your score.

- Please use your credit card for small purchases and pay it off every month. The easiest way to improve your credit score is to use a credit card every month, and pay it off at the end of the month – on time.

Paying on time every month shows that you are responsible. Paying more than the required minimum is also a plus, and not only will you pay less in interest, but your credit score will go up. Using a card that requires you to pay it off every month, are advantageous. - Please read all mail coming from the credit card companies. It could happen that, they might be telling you that they are going to shorten your grace period, or change your account due date. If you’re off by just one day or you’re late, your interest rate defaults, and you can get a hit on your credit score.

- Please never max out credit cards. You should know that, carrying a high balance on your card shows that you are topped off financially. Keep your balances low, to less than 10-20% of the card’s limit, and this will boost your score.

- If it is possible, please have multiple types of credit cards. In fact, credit cards are the main credit building tool, but to have a better score, your credit needs to be well-rounded.

Other types of credit are store credit, personal loans from banks, mortgages, car loans, student loans, etc. - If possible, please take out a extra consumer loan (even if you do not need one), and pay it off before its due to avoid paying too much just for pulling out the loan. That boosts your credit rating. If you are in the market for a car or another big purchase, put down a big down payment, and finance the rest (even if you can afford to buy it outright). Its all part of the credit score game.

- Please read our consumer-friendly and well-written article about

How to add up to 100 points to your Credit Score in a year. Easy to follow tips.

that contain more very interesting every-day tips to follow, in your personal finances.

Please read our other articles about credit score topic, like Credit Reports, Credit Score, Credit History, and

Credit Repair.