|

Consolidate your credit card debt to regain

|

Debt is appearing to be a major hindrance for the U.S. economy (for Americans and Europeans as well) these days. Of course the overall debt problem isn't new at all and the roots of this problem can be traced through the time of recession.

Any wrong decision regarding personal finances may lead you to debt problems.

Any wrong decision regarding personal finances may lead you to debt problems.

|

Mismanagement of credit cards also contributes significantly to the personal finances problem. Research shows that young novice people and specially students who have just started using credit cards are more prone to accumulate credit card debts. Inexperienced and immature handling of finances is the main reason for this. There are countless grown up people too, who use their credit cards carelessly and end up burdening themselves with unmanageable credit card debts. |

|

What is the solution for credit card debts?

Now, if you're already struggling to pay off your credit card debts, then you must immediately start working on them. There are many strategies through which you may do away with your credit card debt, but the most effective option perhaps is credit card debt consolidation.

|

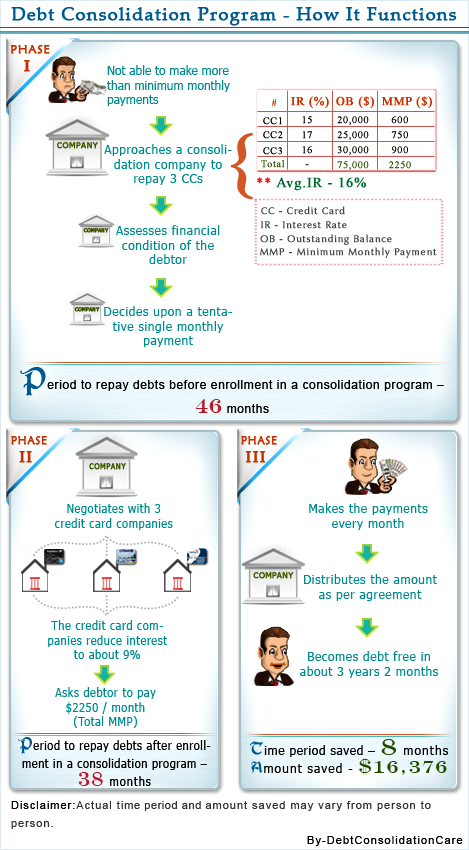

Debt consolidation is considered an incredibly successful solution for people who find it difficult to take care of numerous debts.

Through consolidation you may combine your various debts and pay them off through a simple and single monthly payment. You may talk to your creditors and convince them to reduce the interest rates according to affordability. So quite obviously you will get to save along with paying off your debts. |

You can realize now how debt consolidation may help you out to resolve your credit card debts. All you need to do is to consolidate various debts on your credit card and maintain the payments regularly.

What is the right process for credit card debt consolidation?

The perfect process for credit card debt consolidation has been specified below. Check out the process and learn what you must do:

- Count your credit cards first:

You must list out your credit cards first. Point out how much debt you owe on every account.

Get an overview of your credit card debts to take the next step for consolidation. - Assess your financial standing:

If you're facing any financial hardship, then you must take some time out to evaluate your financial condition. Count your savings and decide how much you can pay immediately to your creditors.

The assessment is necessary to find out your affordability. - Ask your creditors to cooperate with you:

Once you're done with the assessment of your credit card debts and your financial condition, you may contact the creditors. Inform them about the problems you're facing during your debt payments.

You need to convince the creditors well to get significant reduction in the interest rates. Whatever reduction you get, may help you save considerable amount. - Don’t delay your monthly payments:

Consolidation will simplify your payments. You need to follow the payments on a regular basis.

Even a single missed payment may ruin the consolidation process. So be careful and responsible with your monthly payments. - Reduce the usage of credit cards for sometimes:

You must avoid using your credit cards for sometime. Especially during the consolidation process you must shun your credit cards to avoid aggravating the debt problem. Please use hard cash for your purchases. This way, you will control the credit card debts in a big way.

How to make credit card consolidation most effective?

|

People often do some careless mistakes which ultimately mar the consolidation process.

To make the credit card consolidation a sure shot success you must avoid these mistakes. Here are three smart tips which may help you make the most of credit card consolidation:

This article has been contributed by Yasmine, a financial writer. She is a member of Debtcc Community. To know more about her community, please click here. |

|