|

Personal Credit Score |

Knowing your personal Credit Score can really mean the difference between being approved or denied for any kind of credit, credit card or any kind of loan. In the majority cases, Credit Score means also a low or high interest rate, you will be offered by bank or other financial institution.

A good credit score can help you qualify for an apartment rental and even help you get utilities connected without a deposit. So, this is a very important matter for you.

|

Knowing your credit score and monitoring your credit report are crucial for health of your personal finances and important aspects of good

personal financial planning.

The higher your credit score, or FICO score, the more benefits you can participate in, such as being granted a loan with a lower interest rate. A lower credit score can result in higher interest rates on loans or loan denial, at all. |

|

What Is A Credit Score

In fact, your credit score is a three-digit number generated by a mathematical algorithm using information you provided, in your Credit Report.

Credit score is designed to predict risk, specifically, the possibility that you will become seriously delinquent on your credit and loan obligations, in the 24 months time after scoring.

It seems that the FICO credit score dominates this market and likely around 90 percent of all financial institutions in the United States, use FICO scores in their decision-making process.

Credit score is designed to predict risk, specifically, the possibility that you will become seriously delinquent on your credit and loan obligations, in the 24 months time after scoring.

It seems that the FICO credit score dominates this market and likely around 90 percent of all financial institutions in the United States, use FICO scores in their decision-making process.

FICO scores range from 300 to 850, where a higher number indicates lower risk. There are not any standard rules for considering financial risk by lenders.

Please consider below explanation as an informative description only. So, what is a good credit score in FICO rating? See below, please.

Please consider below explanation as an informative description only. So, what is a good credit score in FICO rating? See below, please.

FICO Credit Score Ranges

750+EXCELLENT SCORE

The score of 720 or above means you are in a great financial and credit shape. Everything above 740+ credit score represents an excellent credit risk and an excellent credit history.

The score of 720 or above means you are in a great financial and credit shape. Everything above 740+ credit score represents an excellent credit risk and an excellent credit history.

700-749VERY GOOD SCORE

Generally speaking, a score of 700 or more gets you the best credit and fast loan approvals. Please be aware that credit score between 720-735 is average credit score in the United States.

Generally speaking, a score of 700 or more gets you the best credit and fast loan approvals. Please be aware that credit score between 720-735 is average credit score in the United States.

650-699FAIR (or HIGH GOOD) SCORE

Generally, a score of 650 or above is a sign of very good credit and a very good credit score.

Generally, a score of 650 or above is a sign of very good credit and a very good credit score.

620-649GOOD SCORE

In fact, credit scores in the range of 620-650 indicate basically good credit and very often the minimum for term “good credit score”.

In fact, credit scores in the range of 620-650 indicate basically good credit and very often the minimum for term “good credit score”.

600-619POOR SCORE

Please be aware that score around 620 is considered the dividing line between good and bad credit. Lenders commonly view customers with credit scores from 600 to 620 to be a much higher financial risk.

Please be aware that score around 620 is considered the dividing line between good and bad credit. Lenders commonly view customers with credit scores from 600 to 620 to be a much higher financial risk.

550-599BAD SCORE

Scores below 600 indicate relatively high risk and may result in credit denial or very high interest rates. If the borrower has credit score less than 600 he is generalized as a person who having some credit problems.

Scores below 600 indicate relatively high risk and may result in credit denial or very high interest rates. If the borrower has credit score less than 600 he is generalized as a person who having some credit problems.

Below 550

Everything below 550 is considered very risky and sometimes considered "horrible" credit, with a lot of bankruptcies, credit defaults, trial against, etc.

Everything below 550 is considered very risky and sometimes considered "horrible" credit, with a lot of bankruptcies, credit defaults, trial against, etc.

Elements of Credit Score

The three major credit bureaus, Equifax, Experian and TransUnion, use several factors to determine your credit score, including amount of total debt and the number of credit cards you own, to name a few criteria.

|

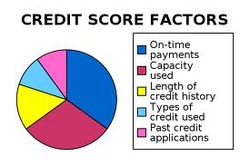

All information you provided in your credit report goes into five major categories that make up an FICO score.

Some factors weights more heavily, some weight less, like types of credit used. Please take a look at the elements of credit score below, to understand which credit score factors are most important. |

|

- PAYMENT HISTORY (35 percent)

This is your account payment information, including any delinquencies and public records.

We think this is the most important factor determining your credit score as all new lenders firstly want to know whether you have paid past loans and credit accounts on time.

Do you think, you will lend your money to someone who does not pay their liabilities on time, to other lenders? We doubt so. - AMOUNTS OWED (30 percent)

This factor generally means, how much you owe on your accounts. You should be aware that, the amount of available credit you are using on revolving accounts is heavily weighted.

This means credit card accounts. So, if you are close to "maxing out" many credit cards has in fact, a high credit utilization ratio and can lower your credit score. In my opinion, please use up to 30 to 40% of your credit limit available on particular credit card account.

Please do not worry as owing money on your credit accounts does not necessarily mean you are a high-risk borrower. However, a larger number of accounts with amounts owed (balance) can indicate higher risk for next lenders. - LENGTH OF CREDIT HISTORY (15 percent)

It says, how long ago you have opened accounts and time since accounts activity. Of course, a longer credit history will increase your personal FICO and any other score. Please note that the length of credit history takes into account:

- how long ago specific credit accounts have been established

- how long it has been since you used your certain personal accounts, including the age of your newest account, the age of your oldest account and there is calculated an average age of all your accounts. - TYPES OF CREDIT USED (10 percent)

This means the mix of accounts you have got. That include all of your credit card accounts, installment loans, retail accounts, mortgage loans, and any other finance company accounts. - NEW CREDIT (10 percent)

Credit inquiries and number of recently opened accounts.

Please be aware that opening several credit accounts in a short period of time represents a greater risk, and for sure affecting your credit score. This is true especially for people who do not have a long credit history.

Negative factors determining your credit score

Below, you will find list of events are considered quite serious in the financial world.

Please note that recent items and those with larger amounts are weighted much more on your score.

However, older items and/or with small amounts will weight less.

Please note that recent items and those with larger amounts are weighted much more on your score.

However, older items and/or with small amounts will weight less.

- Bankruptcies – stay up to 10 years on your credit report

- Lawsuits

- Foreclosures

- Liens

- Wage attachments

- Judgments

We encourage you to learn more by reading article about Credit Score at Wikipedia, the free encyclopedia.